Can You Buy And Add Primary Tradelines Like Authorized Users?

Primary Tradelines Do Not Equal Better Tradelines

Before we dive in, we want to make one thing clear.

You cannot buy primary tradelines to add to your credit report in the same way you can buy authorized user tradelines.

You may have heard otherwise, but we will break down exactly why this is simply not true, and what you should do instead.

There tends to be a lot of misinformation – some of it accidental, and some of it deliberate – surrounding the tradeline industry. That is particularly true regarding primary tradelines.

One of the most common misconceptions we see is that people think they can buy primary tradelines like authorized user tradelines. Before we begin, make sure you understand first what authorized user tradelines are and how they can help you.

Primary tradelines are not the problem; how they’re handled is the problem. While not all companies lie, the credit repair world seems to foster an environment ripe for abuse. This is especially true in an industry where consumers are already in a heightened state of concern for their compromised credit and financial situation.

That’s what we wanted to address: the truth about all the lies when it comes to primary tradelines.

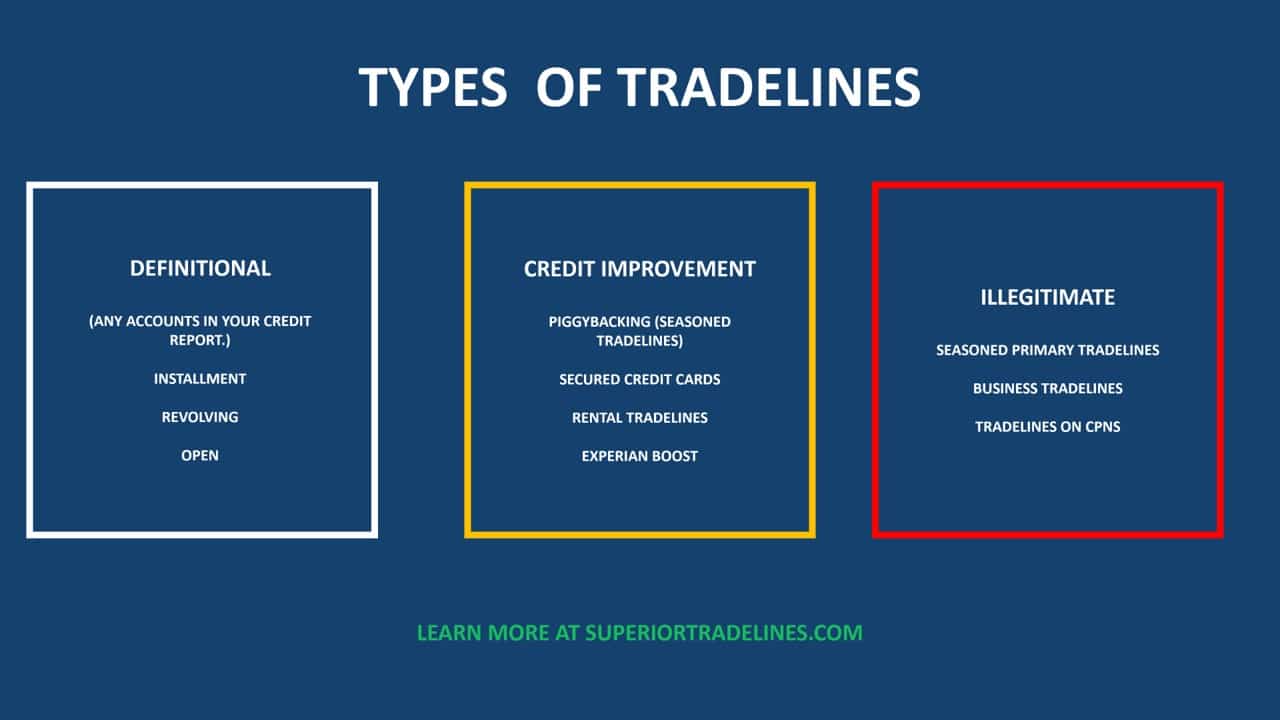

What is a tradeline?

Here’s the quickest, most down-to-earth answer possible: tradelines are accounts in credit reports.

If you have good accounts, you have a good credit score. If you have accounts with negative information, you have a bad credit score. At its most basic level, having (or adding) good accounts to your credit report results in an increased credit score.

What is makes a tradeline “primary”?

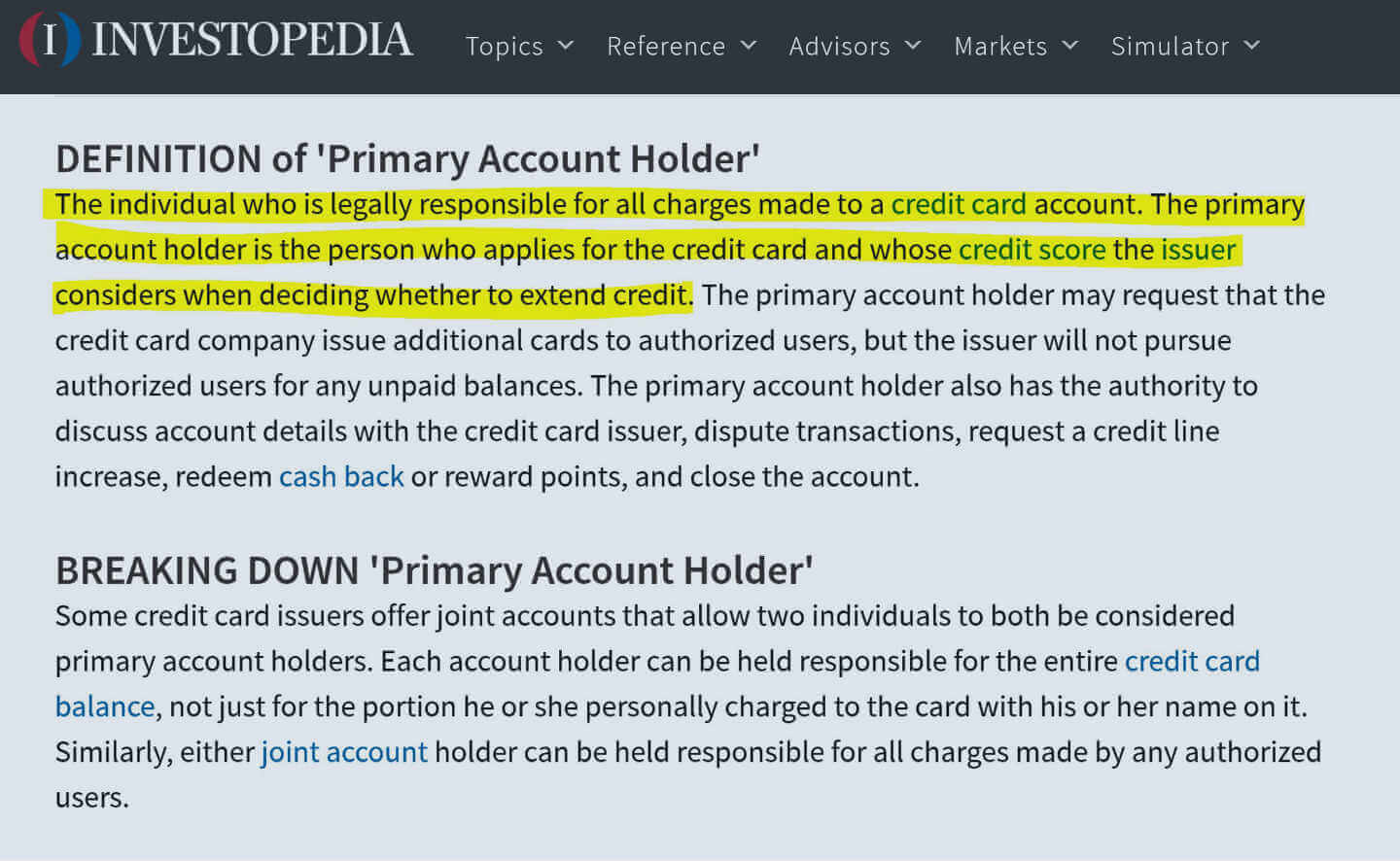

Primary tradelines are an account on a credit report for which the primary account holder is responsible.

This is in contrast to authorized user tradelines, where the account history reports on the authorized user’s credit report (as an authorized user… not a primary account holder). You cannot buy primary tradelines and add them to your credit report.

Every line of credit is a primary tradeline for the primary account holder. Auto loans, credit cards, mortgages – these are all lines of credit that are primary for the primary borrower. The authorized user or joint accounts exist when the primary holder of an account lists you as an authorized user or a joint account holder.

What is an authorized user tradeline?

Authorized user tradelines are simple in theory. You add individuals as authorized users to a credit account in good standing and their credit scores increase. Unlike primary tradelines, you can buy them and add them to your credit report.

“After paying a fee, you are listed as an authorized user on someone else’s credit card, someone with a healthy credit rating. You don’t actually get to use the card, but the credit history of that card appears on your credit report, making it more attractive.”

Brigitte Yuille – Debt Management Reporter for Bankrate

After the Equal Credit Opportunity Act passed in 1974 along with Federal Reserve Regulation B, people who hadn’t had the opportunity to build a reliable credit history were now able. This is because they were then eligible to become authorized users on primary accounts that were held in good standing.

The idea was that you could be added as an authorized user on a family member’s account and benefit from their positive credit history. However, not everyone has a friend or family member who is willing or able to add them as an authorized user.

Thus began the practice of buying and selling tradelines.

Can you actually buy primary tradelines like authorized user tradelines?

The answer to this is that you should not buy primary tradelines, and we’ll explain exactly why.

When the concept of piggybacking off of authorized user tradelines became popular, the “I will one-up you” crowd took the basis of a working product and applied it (in theory) to other products. This is despite the fact it made no sense, was not founded in law, nor did they have any real way to operate it.

Put quite directly, there is no such thing as seasoned primary tradelines. What I specifically mean is that you cannot purchase this type of tradeline and have them added to your credit report.

The majority of the time people “selling” primary tradelines are lying to you and just selling you authorized user tradelines disguised as something else. Which is deceitful, in and of itself.

The reason authorized user tradelines exist at all is the result of complicated federal laws. Specifically, the Equal Credit Opportunity Act (ECOA) of 1974 which was implemented by the Federal Reserve Board Regulation B. These laws only contemplate authorized user status on revolving tradelines… nothing else.

The real question is, “Is it in your best interest to purchase primary tradelines?”

Do you want to purchase primary tradelines when you can get them for free?

You can get primary tradelines for free by applying to a bank that is more likely to give you a chance, like Capital One or Chase Bank. Large banks like these will often approve some credit cards to primary users with zero credit or even bad credit.

There are many scams out there concerning primary tradelines. The legitimate sources are usually buried beneath a sea of propaganda and shady businesses. Get primary tradelines for free from a bank, and boost your credit score with authorized user tradelines from us.

Are primary tradelines better than authorized user tradelines?

There is no cut-and-dry answer to this question, so we will discuss both primary and authorized user tradelines. First of all, the question is more appropriately posed like this: “What do I need, authorized user tradelines, or primary tradelines?”

Primary tradelines are beneficial to your credit score when you have a lack of them. If you don’t have any credit cards in your name, authorized user tradelines can only help so much.

On the other hand, if you have a few young credit cards, have low limits, etc., authorized user tradelines can help place a longer credit history on your report and decrease your debt to credit ratio.

Again, it just depends on what you need. It’s best to just contact us and we can discuss your specific credit situation.

How to get Primary Tradelines

There are several legitimate, versus illegitimate, ways to get primary tradelines. If we haven’t made it clear enough already, if someone is offering to sell you primary tradelines, they are most likely trying to scam you. There are much better ways to go about it.

Legitimate ways to get primary tradelines

There are several reasons for procuring primary tradelines. For example, if you want to start building credit, this is the first place to begin. Also, many banks require more than one tradeline to get approved for a business loan.

If you want to add primary tradelines to your credit file, don’t overthink it! It really is as simple as getting approved for a credit card or loan. If you aren’t able to do that, read on to see what your other options are.

The first, and best way is to get approved for a credit card or loan.

Once you get approved for any kind of credit card or loan, that becomes a primary tradeline listed on your credit report.

This could be:

- an automobile loan

- a mortgage

- a student loan

- or any kind of line of credit issued in your name primarily

As always, taking out a loan can be risky if you’re not prepared to make payments on time. It can be easy to be lured into a false sense of security.

Don’t get caught off guard when the unexpected happens. Always exercise caution before taking out a loan, and prepare for the unknown as best you can.

Some people have a difficult time getting approved for a credit card or a loan. That’s probably why you’re reading this article in the first place. If you haven’t had success in getting approved, we’ve outlined some steps below you can take to help start building a reliable credit history.

If you’re not qualified for a credit card or loan, try a secured credit card.

Yes, getting a secured card can help you establish credit. You simply give your bank money and they convert that money into a primary credit card in your name.

Most banks offer credit solely based on their belief that you will repay them (i.e. your “credit” worthiness). Whereas, banks offer secured credit cards based on the fact that you have “secured” future advances on the card with prepayment.

So, since there’s absolutely no risk, how does this establish credit? Well, you will make payments on the secured credit card just as you would on an unsecured credit card. The banks report your payment behavior to the credit bureaus.

Credit monitoring services, like FICO, use this information to generate your credit score. This usually takes about 6 months of payment history.

The downside to a secure credit card is that, unless you have a lot of cash laying around, you typically open a small secured card. That places you in a more adolescent bracket, in terms of credit scoring. Suffice it to say, use secured cards to break the mold.

But, you’ll eventually want to get into unsecured cards for maximum credit enhancement potential.

If secured credit cards are insufficient, try credit builder loans.

Credit builder loans are perfect for those just getting into the credit game. The good news is that you do not need to have good credit to get approved. The possible downside is that you need to prove you have enough income to make payments.

Another possible downside is that if you are already in debt, credit builder loans may not be enough to help you. Studies have indicated that these are best for people who have no debt history and are brand new to credit.

Credit builder loans can also be somewhat hard to find. They are usually offered by smaller establishments like credit unions or community banks.

Once you are approved, the money is held by the establishment until you finish making payments. In this way, there is very little risk to the bank.

While you make payments, the money accumulates as savings. Your payments are then reported to one or more of the major credit bureaus.

Once again, loans can backfire if you’re not prepared to make payments on time. Negative items on your credit report, such as late payments and overdue balances, will affect your credit score adversely. It can take a significant amount of time and effort to reverse.

Always exercise caution before committing to any kind of loan.

The latest trend… self-lending.

There has been a proliferation of self-lending companies in recent years. This is due to a gap in the market where certain people were considered “unscorable” by credit reporting bureaus. As a result, businesses found ways to create products to start scoring people.

The idea of self-lending is somewhat similar to a savings account. The difference is that it allows you to build credit and savings at the same time. Rather than receiving the loan upfront like in most cases, payments are made in installments. Once the loan is paid off, you receive access to the funds.

This is a relatively risk-free way for creditors to lend to consumers with little to no credit history. The consumer benefits by having the information reported to the three major crediting bureaus.

Convert your utility bills into credit and benefit from on-time payments.

Typically, utility bills only significantly affect credit scores if payments are made late or the account is delinquent. Paying your utility bills on time, however, typically won’t cause your score to go up. If you regularly make on-time payments for rent and utilities, there are ways to add these items to your credit profile so that you can reap the benefits of an increased credit score.

Extra debit card

By opening an account with Extra, you are essentially paying to have them facilitate a connection with each major credit bureau. In turn, your payment information gets reported and added to your credit profile. The Extra debit card acts like a credit card, and as long as your payments are on time, your credit score will go up.

Experian Boost

The benefit of Experian Boost is that it is free and works fast. The downside is that the positive increase is only reported to Experian. That means that if a lender pulls your report from the other reporting agencies, the boost from Experian won’t help.

Lastly, if you are a renter, you could ask your landlord to report your monthly payments. Landlords typically don’t report rental payments because there is a fee to do so. You could always offer to pay the fee for them if they are not willing. However, if you have to pay to do this, there are typically better ways to make the most of your money, such as the methods we mentioned above.

Illegitimate Ways

Tradelines, if acquired correctly, are perfectly legal within the scope of the law (for more information, check out our article Are Tradelines Legal?); however, there is plenty of opportunity to abuse the system and cross the line into illegal territory. Beware of the following practices, as they will only cause you more detriment in the long run.

Phantom Tradelines

On some occasions, certain individuals have been persecuted by the federal government for generating false information to send to credit bureaus to build out fraudulent identities.

They would then make it appear as if this “person” had excellent credit, and would then open up primary lines of credit using this “person’s” name.

Next, they sold these fake lines of credit as authorized tradelines, promising a more attractive credit rating. They sold these fake lines of credit for a significant profit, and even used the increased spending limits to rack up further debt for themselves.

Naturally, once the federal government caught on, these fraudsters faced significant penalties and prison time. However, it’s important to realize that there are still plenty of scam artists out there, so it’s important to know what to look for to make sure you are not getting taken advantage of.

Tradelines Procured Through Fraud

Credit agreements are legally binding documents, so any time that you provide personal information to a lender, you are required to be 100% truthful about all the information provided.

Thankfully, in the modern digital era it has become much easier for lenders to vet information, but sometimes falsified documents can slip through the cracks. Not all lending requests are fully investigated, so some people may try to take advantage of this oversight.

It may be tempting to stretch certain details, such as exaggerating your income, but in doing so you would be committing fraud, which is a federal crime, and would likely face serious repercussions.

Using fake identities, such as CPNs (or Credit Privacy Numbers) is also a fraudulent practice and should never be utilized unless you’re ready to face serious consequences.

Let’s cut to the chase…

If you’re on this page, you’re probably looking for a shortcut to obtaining credit. Sometimes the best shortcut is really just to take the right steps to get back on track. We’ve outlined a few steps below on how to do exactly that:

- Pay your bills on time. Don’t take out any loans you’re not prepared to pay, and always be prepared for the unexpected.

- Get added as an authorized user to a primary account that is in good standing, either through a friend or family member, or through a professional tradeline company.

- Don’t get sidetracked by fraudulent tactics. As with most things in life, the right way is not always the easy way. Don’t risk taking legal shortcuts as they could just take you further away from your goals in the long run.

- Ask for a raise from your boss. It’s hard to build credit if you don’t have enough income.

- Know what your goal is, and take the most direct path to it. It is easy to get lost in a sea of confusing terms and jargon and make things far more difficult than they need to be. Get in touch with one of our professional advisors who can help outline your goals and take the appropriate steps to achieve them.

- Think holistically about your credit future and make good decisions. Slow and steady often wins the race. Examine your spending and lifestyle habits mindfully, and make changes as necessary.

In conclusion: don’t buy primary tradelines.

You cannot purchase “primary tradelines for sale.” Period. End of story. If someone says they are selling you primary tradelines, they are in actually just selling you authorized user tradelines, and taking advantage of your naiveté. Someone who willingly deceives you is not someone worthy of your trust.

It is such a ridiculous idea, too. For example, I have a lot of people with student loans. Want to buy one of them? There are mortgages and car loans out there. Want to pick up one for a few thousand dollars?

Even if it were possible (or legal) to purchase “primary” tradelines (like seasoned authorized user tradelines), you would be hurting yourself… not helping yourself. The result would be an increase in your debt and financial responsibilities, which would likely lower your debt to credit ratios and your chances of being approved for future lines of credit. This makes absolutely no sense, so stay away from people “selling” primary tradelines.

We advocate getting your own new primary line for free. Purchasing primary tradelines can be illegal. Most of the time, it is a scam.

If you are here to improve your credit in the most efficient way possible, that is what we do, and we do it with authorized user tradelines. Talk to one of our advisors today to get started.